Design advances from classic products to design-driven data and technology business

In light of fresh industry figures, the image of Finland as a design country with its design classics is all water under the bridge. In 2020, the turnover of the digital design industry grew to EUR 9.1 billion.

The employment and turnover of software and video game companies that make strong use of design have continued to grow rapidly over the past ten years. The data can be found in the newly published structural business and financial statement statistics from Statistics Finland, and will be published in the Economic outlook survey of Finnish design 2022.

Many companies in the design sector are now making serious use of service design: a variety of companies are establishing design units at a fast pace. The technology, data and design company Solita provides an example of this change. Business Director Aleksi Issakainen from the design unit at Solita considers design of integral importance to the company.

“In two years, the use of design in digital services and business development has doubled the company’s expertise in service design to a comprehensive business, employing nearly 160 people in five countries The technology company with its nearly 1,700 experts now has fewer and fewer projects where digital design, human sciences, business planning and service design would not be utilised”, says Issakainen.

The company has become known for, among other things: Koronavilkku, but also, i.e., the development of circular economy services for Fiskars.

The development that has occurred in the software business is strongly linked to the digitalisation of society and business. Salla Heinänen, Executive Director at Ornamo, has followed the growth of design with satisfaction.

“Design is based on human understanding, and as a field of expertise, its potential as part of the digital economy has been clearly identified. Large Finnish technology-driven companies are prominent power users of design,” Heinänen emphasises.

She points out that small design companies also see the digitalisation of the industry as an opportunity. According to Heinänen, the ongoing reform of the Standard Industrial Classification should take into account new digital sectors in order to obtain comparable and well-targeted data.

Digital design is growing rapidly

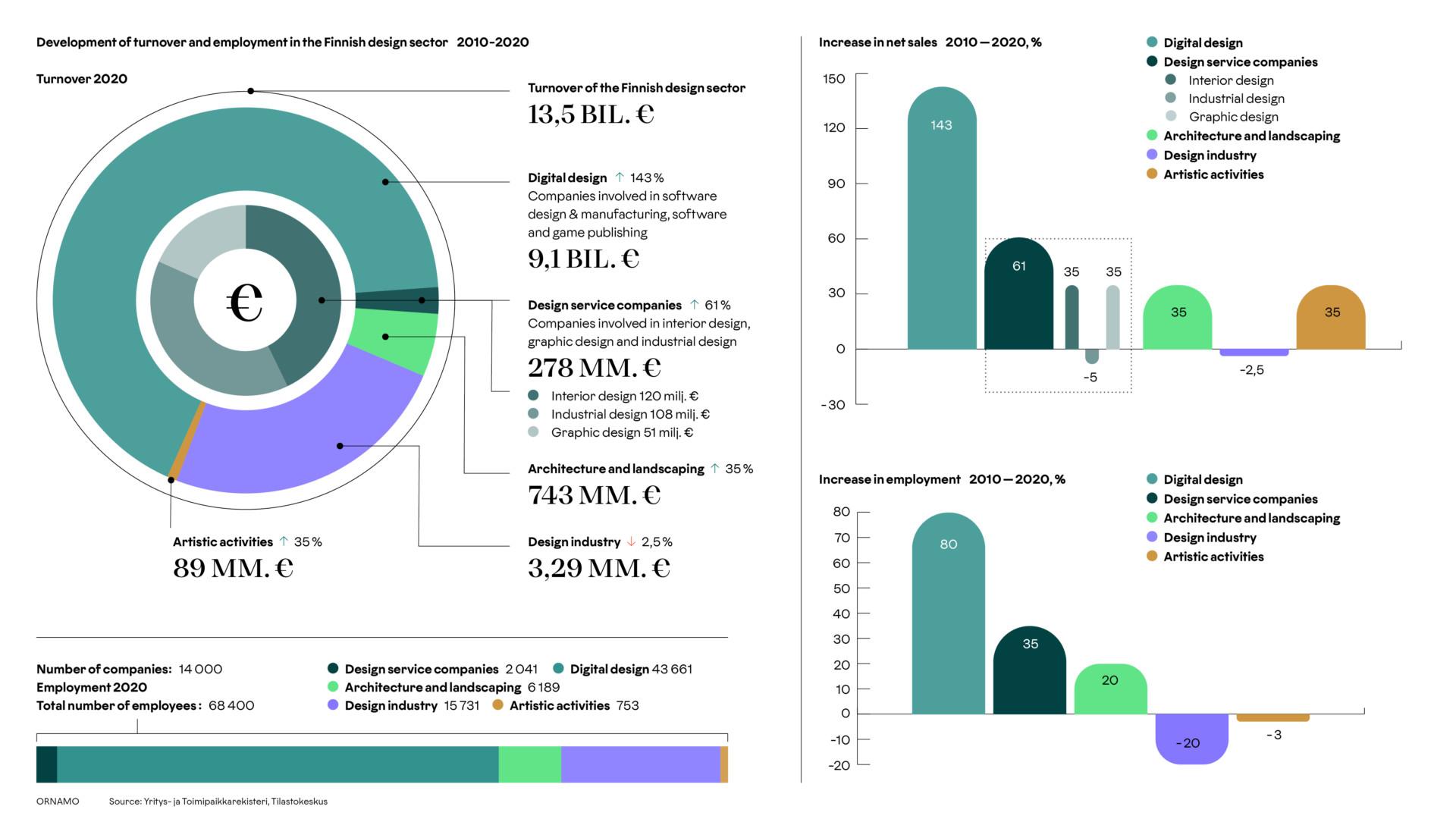

During a ten-year review period (2010–2020), turnover has been growing strongly in the field of digital design. The industry consists of software design and manufacturing, as well as companies within the gaming industry. In 2020, the turnover of these companies grew to EUR 9.1 billion, with a total of 44,000 employees. In ten years, the turnover of the industry has grown by as much as 143%. The sector is also the largest employer, employing 43,661 employees in 2020.

In the field of digital design, the number of employees increased by 79.5% in a decade. At the same time, the more traditional design-intensive industry has continued to decline in turnover, to 3.3 billion.

The turnover of the more traditional design industry has fallen by 2.5% in a decade. In 2020, the sector employed 15,731 people; the number of personnel decreased by 22% compared to 2010. The industry comprises companies manufacturing e.g. textiles, clothing, wood and glass products, and furniture.

Design service companies have increased their turnover by 61%. The companies included offices of graphic design, interior design and industrial design. Design agencies employed 2041 people, and the number of employees grew by almost 35% over the decade.

The design of built environments (architecture and landscape management) experienced almost 35% growth in turnover in ten years. In 2020, the sector employed 6,189 people, increasing the number of employees by nearly 20% in a decade.

Design companies report relatively positive profitability and performance

The economic outlook survey also mapped design companies’ views on the future and the past year. Companies share a positive outlook on their future, despite the consequences of the war in Ukraine and the energy crisis. The survey was conducted by researcher Pekka Lith in September through October 2022. A total of 90 entrepreneurs from different fields of design participated in the survey.

Nearly half of the participants represented design agencies. Nearly 58% of the companies estimated that their profitability had remained unchanged or slightly weakened compared to the previous year. Of the same businesses, nearly 72% estimated that the turnover, personnel, profitability, and production costs for the coming year will either remain unchanged, or improve slightly or clearly.

Regarding turnover, profitability, and production costs, the surveyed companies have more positive expectations compared to other SMEs.

According to Executive Director Salla Heinänen at Ornamo, this economically challenging situation requires public funding to acknowledge small employer enterprises and to build funding opportunities for companies in scalable creative industries. Heinänen considers it significant that 60% of all survey respondents stated that their solvency has remained unchanged. Solvency is the ability of a company to meet its financial obligations.

“In particular, it is essential to extend Business Finland’s funding to more growth-oriented companies in the creative industries. It would be good for Finland to focus on strengthening the RDI financing of large companies in the industry, but also of small companies in IPR-intensive sectors”, states Heinänen.

Compared to the two previous years, the importance of foreign activities in the turnover has also decreased in 2021. The main market areas of enterprises involved in foreign activities have remained the same: In addition to the EU countries and Switzerland, the Nordic nations and Japan are the most important market areas for the participating firms.

The participating companies actively develop their operations and easily use new technologies. According to the survey, a large part of the turnover in the sector is invested into research, development and innovation activities. The proportion of companies that invested five to ten% of their turnover rose significantly. The companies in the sector are also on the forefront of diverse, high-level digitalisation.

Concerning how to improve their operations, design companies emphasised differentiating themselves from market competitors, promoting marketing and sales, developing customer relationships and partnerships, a digital business environment as well as product and service development. In addition, 63% considered it important to promote ethical and ecological policies.

About the Economic outlook survey

The survey was conducted by researcher Pekka Lith in September through October 2022.

The survey received 90 responses up to the deadline. More than half of the respondents (53%) consisted of design and interior design agencies, companies providing consulting services, and architectural and engineering services. 22% were engaged in small series production. The rest work in wholesale and retail, in arts and in small series production

The majority of respondents were microenterprises, as 96% employed fewer than 10 people. The legal form of the enterprises also indicates the small size of the enterprises. Approximately 41% of the respondents were private entrepreneurs. Nine per cent worked as freelancers without having a company. 48% were limited liability companies.

Additional information:

Elina Perttula

Communications Manager

Ornamo ry I Ornamo Art and Design Finland

+ 358 (0)43 211 07 55

elina.perttula@ornamo.fi